Simple depreciation formula

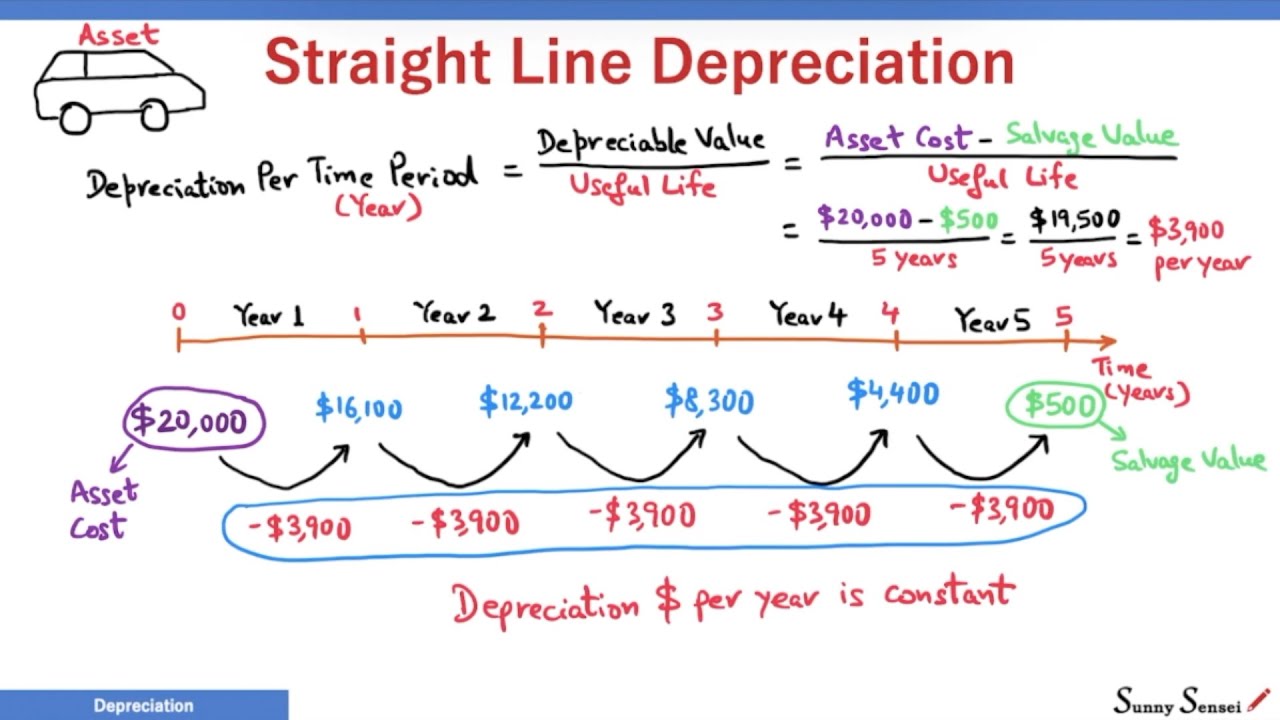

Straight line depreciation cost of the asset estimated salvage value estimated useful life of an asset. Interest increases the value of the principal amount whereas with simple decay.

What Is Straight Line Depreciation Method Pmp Exam Youtube

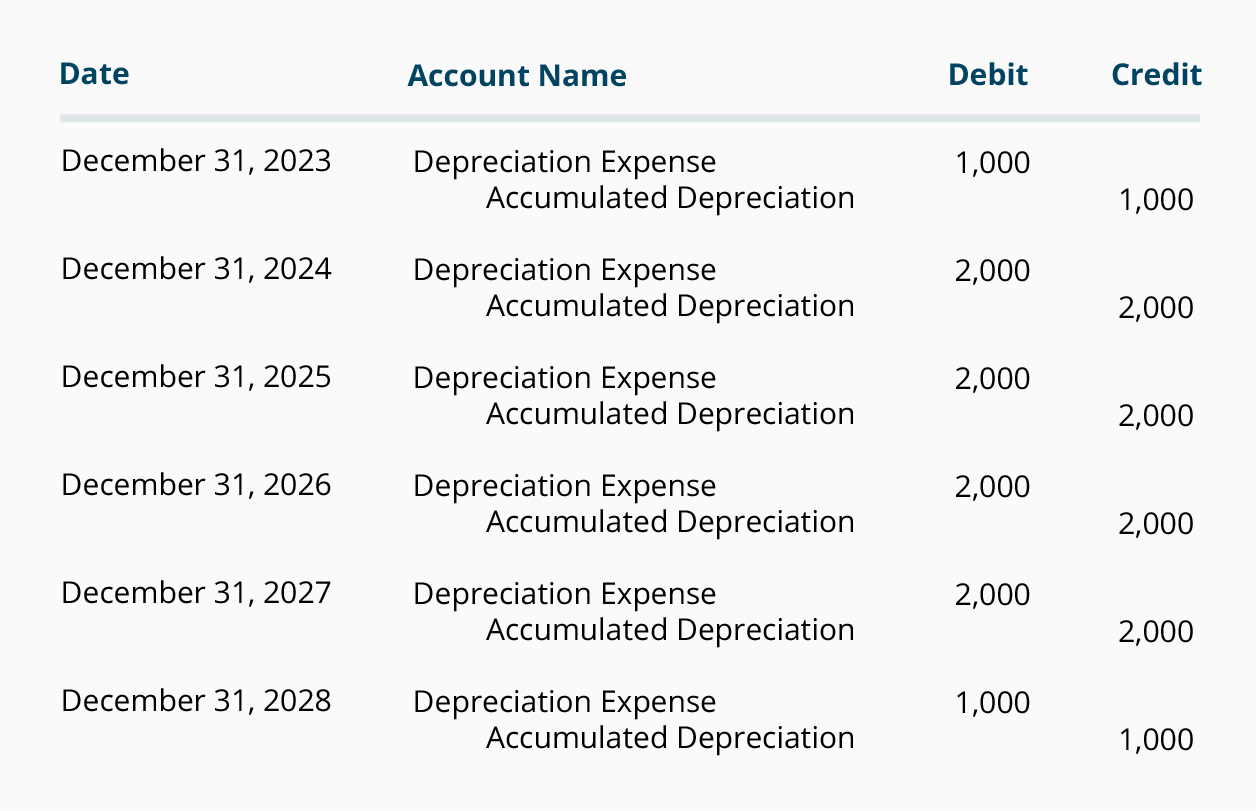

Book value Cost of the asset accumulated depreciation.

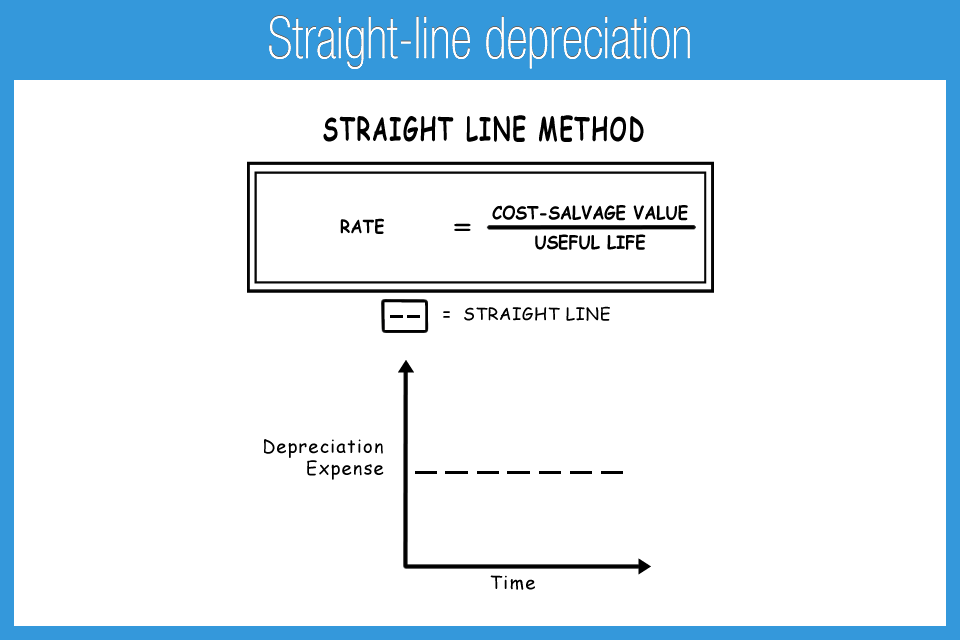

. The straight line calculation as the name suggests is a straight line drop in asset value. Depreciation 2 Straight line depreciation percent book value at the beginning of the accounting period. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

The depreciation of an asset is spread evenly across the life. The following calculator is for depreciation calculation in accounting. Example of Accumulated depreciation formula using double declining balance method.

The formula for calculating straight line depreciation is. It takes the straight line declining balance or sum of the year digits method. The Depreciation Schedule is used to track the accumulated loss and remaining value of a fixed asset based on its useful life assumption.

The straight-line depreciation method is a simple and reliable way small business owners can calculate depreciationJoshua Kennon co-authored The Complete Idiots Guide to. Straight-line depreciation is a simple method for calculating how much a particular fixed asset depreciates loses value over time. Depreciation is a non-cash expense that reduces the.

If you are using the double declining. Cost of Asset is. Calculating Depreciation Using the Units of Production Method.

Asset cost - salvage valueestimated units over assets life x actual units made. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. The straight-line method of depreciation.

A P 1in A P 1 i n Note the similarity to the simple interest formula A P 1 in A P 1 i n. Double-declining balance methodà Purchase Price Salvage Value X 1 Years in.

Method To Get Straight Line Depreciation Formula Bench Accounting

Lesson 7 Video 3 Straight Line Depreciation Method Youtube

Accounting With Damien Labrooy 𝐖𝐡𝐚𝐭 𝐢𝐬 𝐒𝐭𝐫𝐚𝐢𝐠𝐡𝐭 𝐋𝐢𝐧𝐞 𝐃𝐞𝐩𝐫𝐞𝐜𝐢𝐚𝐭𝐢𝐨𝐧 With The Straight Line Depreciation Method The Value Of An Asset Is Reduced Uniformly Over Each Period Until It Reaches Its

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Accountingcoach

Straight Line Depreciation Formula And Calculation Excel Template

Straight Line Depreciation Formula Guide To Calculate Depreciation

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Straight Line Depreciation Formula And Calculation Excel Template

1 Free Straight Line Depreciation Calculator Embroker

Depreciation Formula Examples With Excel Template

Exercise 6 5 Compound Depreciation Year 10 Mathematics

Straight Line Depreciation Account Salvage Value

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation All Concepts Explained Oyetechy

Depreciation Expense Double Entry Bookkeeping

Declining Balance Depreciation Double Entry Bookkeeping